German Firms and Chinese Cash: Dependence or Delusion?

In this op-ed, Simon Laube of the International Business Advisory team at Dezan Shira & Associates’ Shanghai office, examines the assertion that corporate Germany is dependent on Chinese profits, demonstrating that extrapolating broad conclusions from individual cases does not provide the full picture.

In the debate on investment and trade with China, German executives are increasingly confronted with public sentiment when making business decisions. In this op-ed, I test the argument that Corporate Germany became dependent on profits from China and show that inferring the generality from the individual case doesn’t do the job.

As pointed out in Germany’s recently released Strategy on China:

“The Federal Government is not seeking to engage in any decoupling with China. We want to preserve our close economic ties with the country. However, we want to become less dependent in critical sectors in order to reduce the risks they entail.”

Here is why…

Investment

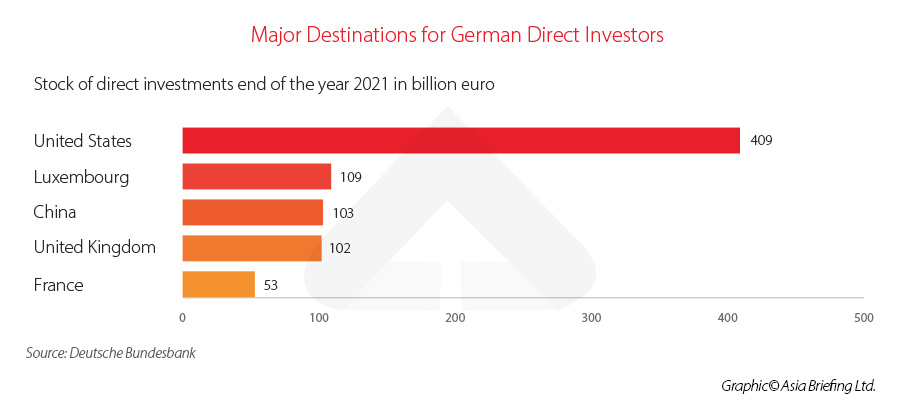

According to the German Economic Institute (IW), Cologne, six percent of the 40,000 German companies registered abroad are in China versus 12 percent in the US. Total annual revenues of German companies abroad grew to 3.1 trillion euro in 2020, of which almost 11 percent was generated in China, compared with 17 percent in the United States.

While the stock of German foreign direct investment (FDI) in China grew from 29 billion euro in 2010 to almost 90 billion euro in 2020, the growth further accelerated in the pandemic years. A record 10 billion euro was added in 2021, followed by another record of 11.5 billion euro invested in 2022. Although, as pointed out by the European Chamber of Commerce in China, the concentration of European FDI in China is increasingly tilted towards big companies. In 2021, the 10 largest investors accounted for 71 percent of all European FDI in China, while four German firms alone contributed 34 percent.

However, the total stock of German FDI also rose by eight percent in 2021 to over 1.5 trillion euro, of which the largest receiver is the European Union (EU), accounting for more than one of every three euro invested. The largest single country was the US, receiving 29 percent. Meanwhile, China’s share in German FDI remained rather constant over the past decade, just short of seven percent.

In fact, Germany has so far made roughly the same amount of direct investment in China as in the UK.

Profits from German equity capital in China have also grown strongly, from under six billion euro in 2019 to over 15 billion euro in 2021. This means that the absolute amounts of profits from German equity capital in China and the US are largely at the same level. However, given the relatively small stock of investment, China appears to be very lucrative.

To be specific, in the five years from 2017 to 2021, profits from China accounted for between 12 to 16 percent of all profits generated by German firms abroad. In addition, more than half of the profits generated in China flowed back to Germany. Between 7 to 11 billion euro was distributed to Germany annually in the same time period.

Thus, return on investment in China was high over the past decade. Yet, German FDI in China remains comparatively low, with the bulk being attributed to very large corporates.

However, to determine monetary dependence, we should be looking at the impact of profit reflows on the German economy. The Bundesbank, in a special analysis for the IW, estimates the share of profits transferred from China annually in the years from 2016 to 2020 to range between 2.2 and five percent of global profits of non-financial German firms. For the economy overall, this does not tell a story of great dependence.

And there is more…

Trade

In 2021, the EU received 22.3 percent of all its imported goods from China, while Germany sourced 8.2 percent of its imported goods from the People’s Republic. In both cases, the share is about twice as high as vice versa. Among China’s goods imports, 10.6 percent came from the EU with Germany accounting for 4.2 percent of the total. Note, for every 10-euro worth of EU goods entering China, 4 euro are received by German firms.

The export shares in mutual trade in goods paint only a slightly different picture. Of all EU goods exports in 2021, 10.2 percent landed in China, while China received 7.6 percent of all German goods exports. China, on the other hand, sent 12.8 percent of all its exported goods to the EU and 3.4 percent to Germany. Naturally, China is more important for German exporters than Germany is for Chinese exporters (just compare the market size). However, again, Germany pays one of every four euro on Chinese goods entering the EU.

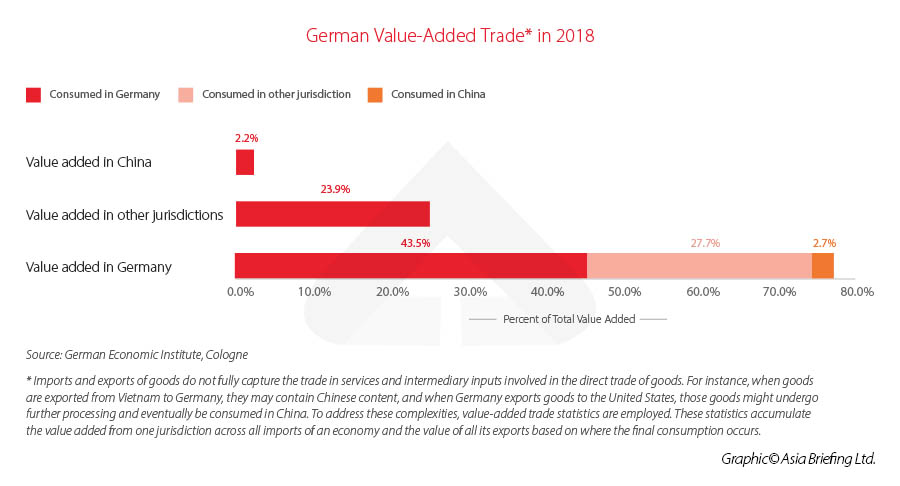

To be more precise, imports and exports of goods fall short of identifying trade in services and intermediary inputs from other countries in the direct trade of goods. To account for origin of value, we may leverage the Trade-in-Value Database (TIVA) provided by the Organisation for Economic Co-operation and Development (OECD), although such data is only available until 2018 due to its complex processing.

Based on TIVA data, as analyzed by the IW, China’s share in Germany’s value-added imports is one fifth larger than its share in Germany’s goods imports. Similarly, Germany’s share in China’s value-added imports was 10 percent higher than its share in China’s goods imports.

The pattern is similar for exports. China’s share in Germany’s value-added exports was almost one quarter higher than its share in Germany’s goods exports. Likewise, Germany’s share in Chinese value-added exports was one third higher than its share of goods exports received in 2018.

This highlights the mutual importance of China and Germany for services and intermediary goods in the products traded with third countries.

The bottom-line

If we take the adjusted data from 2018―to account for higher interdependence―and benchmark it against total value creation, we get a more accurate sense of economic exposure. However, even then, imported value added from China explains only about 2.2 percent of total value creation (consisting of German GDP and imports), while value-added exports to China accounted for 2.7 percent. For China, the figures are naturally lower, reflecting the different size of the economies. Value-added imports from Germany contributed 0.8 percent to total value creation from the Chinese perspective, while value-added exports to Germany accounted for 0.6 percent.

A similar picture emerges by looking at jobs. In 2018, an estimated 1.1 million jobs in Germany were linked to export business to China, which is 2.4 percent of all German jobs. The figure of Chinese jobs depending on exports to Germany was 4.1 million, which accounted for 0.5 percent of all Chinese jobs.

The German Council on Foreign Relations published in its China “De-risking” policy brief in June 2023 the following about bilateral trade and FDI:

“While these macroeconomic numbers are more substantial [for China] than for other EU countries, they as such do not tell a story of excessive exposure. In fact, the standard trade models come to costs of 0.5 to 1.5 percent of [German] GDP. These costs are big and dwarf those of Brexit. But they are still relatively small compared to the costs of the Covid pandemic or the risks resulting from banking crises.”

There has been a lot of smoke and mirrors in the debate on dependence. It remains our hope that public perception will follow the German Federal Government in its shift towards being specific in identifying risks.

An extended analysis with source information, titled Wieviel China steckt in Deutschland? has been published on China Briefing in German.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Monthly Tax Brief: July 2023

- Next Article China’s Tax Incentives for the Manufacturing Sector in 2023