China’s New Foreign Investment Law: A Backgrounder

- China’s new Foreign Investment Law will come in effect January 1, 2020.

- The Law will replace existing laws on wholly foreign owned enterprises, Sino-foreign contractual joint ventures, and Sino-foreign equity joint ventures.

- The new Foreign Investment Law follows China’s moves to further open its market and level the playing field for foreign businesses competing with domestic private firms and state-owned enterprises.

- China hopes the updated legislation will improve the country’s ease of doing business, which has begun to lag and coincides with rising competition from ASEAN for foreign investment in the region.

On March 15, 2019, China passed a new Foreign Investment Law (FIL), a landmark legislation that’s stated aim is twofold: improve the business environment for foreign investors and ensure that foreign invested enterprises participate in market competition on an equal basis.

The FIL will come into effect on January 1, 2020 and will be a new guiding document governing foreign investment in China.

After the reform was announced, the in-country foreign investment community struggled to assess its meaning.

Foreign investment groups in the country were concerned about the reform’s opacity, while overseas media placed the reform within the larger debate on the US-China Trade War.

Here, we attempt to frame these views in the context of China’s long-term reform trajectory.

Expedited legislation

The new FIL was passed only three months after being brought back onto the agenda by Chinese policymakers, an unusually fast turnaround in China, where the same level of legislation often takes years.

Notably, however, an earlier version of the FIL was introduced in 2015 – it was put on the back-burner at the time due to disagreements between policymakers on its content.

Some reports suggest that the Law’s sudden rush back on to the agenda is an attempt by the Chinese government to respond to international criticism from the US and others about China’s openness – or lack thereof – to foreign businesses.

China’s accumulated foreign direct investment (FDI) exceeded US$2.1 trillion by the end of 2018, ranked second in the world according to the United Nations Conference on Trade and Development (UNCTAD).

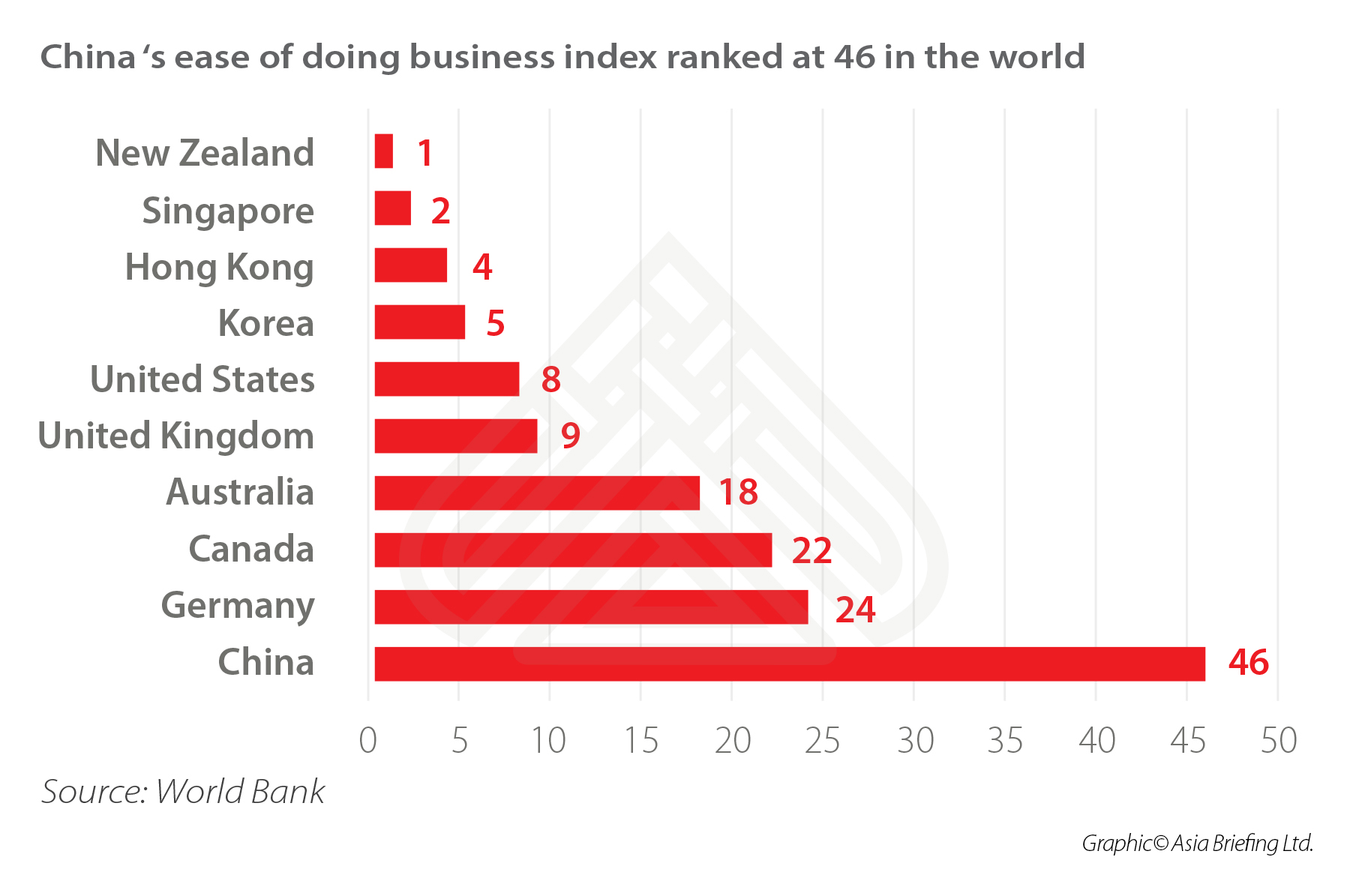

Yet, according to World Bank’s newest index, China’s ease of doing business score only ranked 46 in the world, still behind many countries such as the US, Malaysia, Germany, and Russia.

In this context, it’s clear to see why China needs a law like the FIL to demonstrate a commitment to a more open and transparent business environment for foreign investment.

Other reports maintain that the legislation was inspired by another concern: the three existing laws on wholly foreign owned enterprises (WFOEs), Sino-foreign contractual joint ventures (CJVs), and Sino-foreign equity joint ventures (EJVs) are no longer serving the needs of the economy.

These corporate establishment structures were announced between 1979 and 1990, the early years of China’s economic opening.

With China’s economic growth slowing down, and ASEAN’s rise as an alternative FDI destination, China needs a more welcoming investment climate to remain competitive.

More and more labor intensive and export-oriented industries are relocating to ASEAN countries for lower costs.

For example, in 2017, FDI inflows into ASEAN countries increased by 11 percent, far more than the two percent FDI increase in China in the same period.

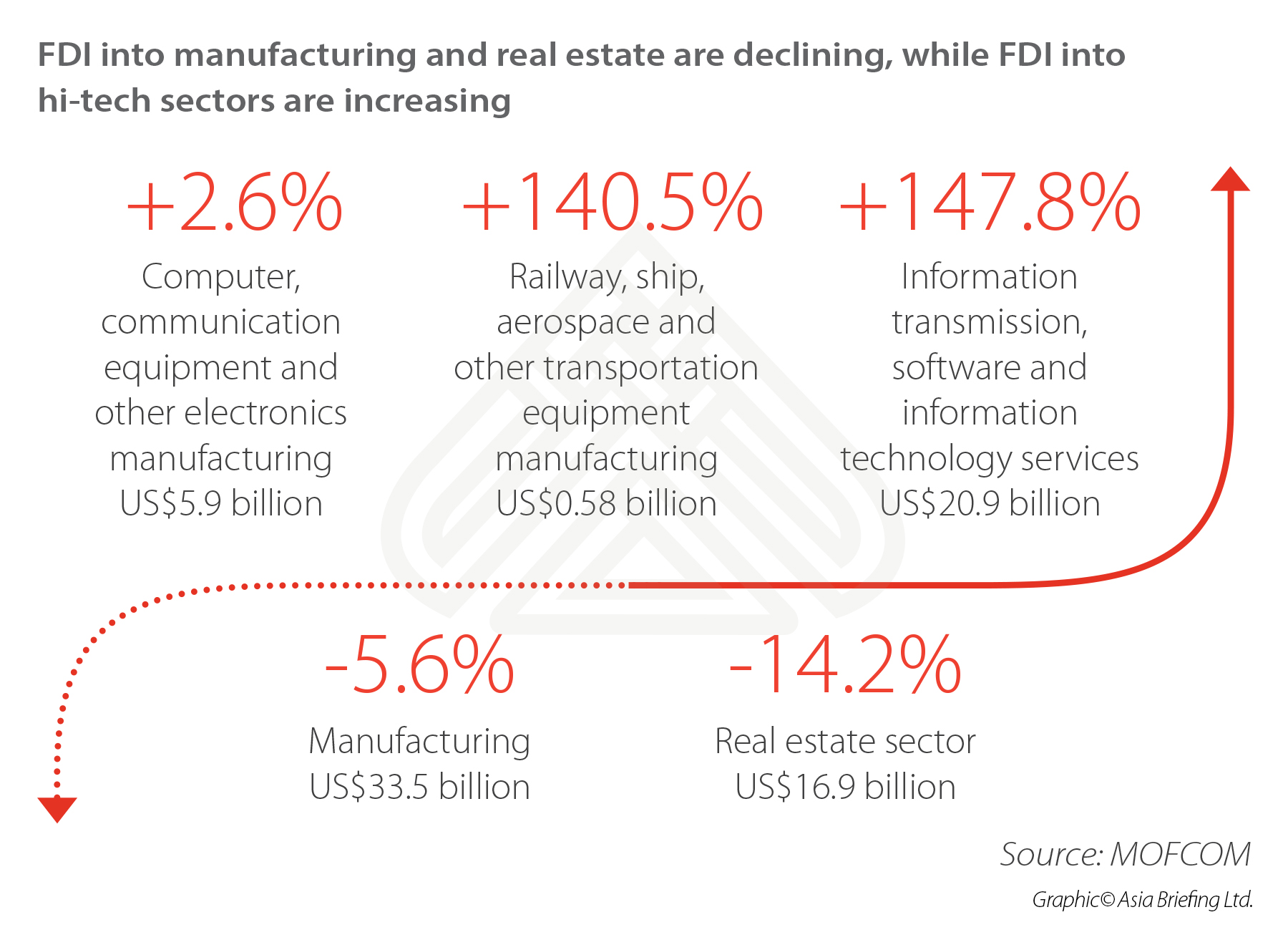

Key FDI sectors are also changing.

The proportion of FDI into general manufacturing and real estate sectors are declining, while the proportion of FDI into high-tech industries, such as computer, internet, and finance sectors, continues to rise.

In this context, China needs a modern, unified law to reflect its new economic structure and assure the foreign investment community about the incentives associated with investing in the country.

Positive interpretations of the FIL

As a legislative effort to improve the foreign investment climate, the new FIL shows China is getting more serious about protecting investor’s rights.

The new law lays great emphasis on equal national treatment of foreign investment, putting foreign investors on a more level playground with domestic investors, and giving them equal protections.

It seeks to address common complaints from foreign businesses and governments, such as by explicitly banning forced technology transfers, promising better intellectual property rights protection, and ensuring equal treatment for foreign firms in government procurement.

In addition, the new law could help to create a law-based environment to protect foreign investor’s legitimate rights and interests, which is closer to international practices.

With the new law, the local government has to standardize their administrative actions on foreign investment and make sure their officials act lawfully. Illegal behavior by officials – such as the misuse of authority, neglect of duty, self-seeking misconduct, and disclosure of trade secrets – may result in criminal charges.

Moreover, the unified governing law for foreign investment could help reduce confusion for new foreign investors in the future, easing the process of investing and doing business in China.

Concerns over new provisions in the FIL

Despite assurances from government officials, many analysts are unsure whether the legislation will benefit foreign investors looking to do business in China.

This is partly because the new FIL is too general in nature and leaves many details to be addressed in other regulations. As the BBC has reported, the Law is seen “as a kind of sweeping set of intentions rather than a specific, enforceable set of rules.”

The lack of details could cause loopholes to emerge that may bring new difficulties for foreign business operating in China.

For example, the FIL forbids forced technology transfer by “administrative means,” but does not define what “administrative means” are.

Moreover, in practice, the government may apply non-administrative measures to acquire technology from foreign invested enterprises (FIEs).

In addition to concerns over the FIL’s vague wording, some observers believe that new provisions may in fact empower the government to intervene in investments in the event of a dispute with a foreign country.

For example, according to the FIL, foreign investments could be expropriated under “special circumstances” and “for the public interest” and are subject to broad national security reviews.

This may give the government a statutory basis to retaliate against a foreign company in the event of an international dispute.

Other aspects have businesspeople concerned about how the FIL will be interpreted and implemented in practice.

Although China promised measures will be implemented based on the central government’s interpretation, businesspeople are concerned they will remain subject to inconsistent implementation by local governments, which has been common in China over the past several decades.

What FIL developments to track

Despite concerns over the vague wording and the potential selective implementations, the new FIL is in many ways a step to the right direction – a unified and standardized FIL to address long-existing issues in foreign investment.

Foreign investors that want to hold a cautiously optimistic view stand on good ground.

As the new FIL will replace the current three laws on WFOE, CJV, and EJV, which have been governing the FIE’s establishment and management over the past few decades, investors should pay more attention to the FIL’s practical implications to their daily operations or future investments.

For example, the FIL will lead to the change of company structures, especially for JVs.

Investors should proactively assess the FIL’s impact as it develops further, keeping a close eye on the supporting legislation, regulations, local administrative approvals, and even “window guidance” of relevant bureaus in charge.

In addition, investors should pay attention to missing details that may affect the foreign investment in a more general way, such as the definition of “foreign investors”, the specifics and procedures of “national security review”, as well as the attitudes towards variable interest entity (VIE).

Kyle Freeman, International Business Advisory Manager at Dezan Shira & Associates told China Briefing, “The new foreign investment law is fairly light on actual substance and should be read as an overarching framework. The subsequent provisions of detailed implementation rules, especially their timeliness and interpretive content linking to other laws, will be critical in the successful implementation of the law.”

According to the official legislative plan, the supporting laws are most likely to be passed by the end of 2019 – this will be a good time to call your advisers for a review.

(This article is part one of a three-part series on China’s new foreign investment law. It was originally published in the magazine, The New Foreign Investment Law in China, produced by Asia Briefing.)

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China Visas Explained

- Next Article China-Singapore FTA: Protocol to Upgrade Agreement in Effect from October 16